Rs 200 crore riddle in NDTV deal: : NDTV gave up a sum of Rs 207.23 crore that they could have potentially earned from the sale of 1.75 crore shares in the news broadcast company

Don't Miss

Under the original terms of the agreement, the Adani group was supposed to pay the Roys a base price of Rs 368.43 per share

|

| Gautam Adani: File Photo |

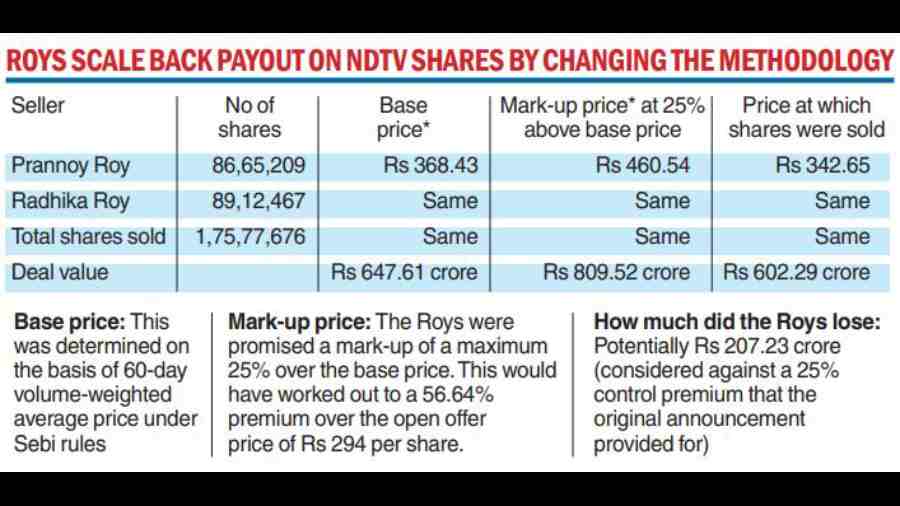

TT Special Correspondent | New Delhi | 31.12.22 : Prannoy and Radhika Roy — promoters of New Delhi Television (NDTV) -— gave up a sum of Rs 207.23 crore that they could have potentially earned from the sale of 1.75 crore shares in the news broadcast company after mysteriously changing the mode of the transaction less than a week after sealing the deal with the Adani group.

On Friday, the Roys sold the shares in NDTV to RRPR Holding Pvt Ltd — an eponymous firm that still bears the initials of the NDTV promoters but has been owned and controlled by the Adani group since August — through a block deal on the NSE at a price of Rs 342.65 per share.

Shares of NDTV closed at Rs 345.60 on the BSE and at Rs 348 on the NSE.

Under the original terms of the agreement, the Adani group was supposed to pay the Roys a base price of Rs 368.43 per share based on NDTV’s volume-weighted average market price in the 60 trading days preceding the December 23 announcement.

The deal also provided for a mark-up over the base price which would be capped at 25 per cent over the base price. This would have worked out to Rs 460.54 per share. At this price, the Roys could have received a sum of Rs 809.52 crore.

At the price that the deal eventually went through under a market-driven mechanism, the Roys stand to receive just Rs 602.29 crore.

Roys resign

Late on Friday night, NDTV said in a notice to the stock exchanges that Prannoy Roy, his wife Radhika, non-executive director Darius Taraporvala, and independent directors Kaushik Dutta, Indrani Roy and John Martin O’Loan had resigned from the board of directors.

“I am resigning owing to the change in the ownership of the company,” Prannoy Roy said in his letter, which was echoed by the others in their epistles.

The company named former bureaucrats Aman Kumar Singh -– currently brand custodian of the Adani group -- and Sunil Kumar as directors of NDTV. Kumar is a former chief secretary of Chhattisgarh.

The NDTV board accepted applications from Prannoy and Radhika Roy to be reclassified from promoters of NDTV to the public category of shareholders.

“I am neither engaged in the management or day-to-day affairs of the company, nor do I have the right to appoint a director or ability to control the management or policy decisions of the company in any manner whatsoever,” Prannoy and Radhika Roy said in identical letters to the company’s board, signalling the end of their 33-year stewardship of the private news channel.

The flip-flop

It is not known why the Roys — who will continue to hold a combined 5 per cent stake in NDTV — changed their mind on the methodology for pricing the transaction.

Some speculated that both the Roys and the Adani group wanted to sidestep controversy arising from the 56.64 per cent premium that the NDTV promoters could have potentially received under the original terms.

The minority shareholders had been offered just Rs 294 per share in the open offer that closed on December 5 –- just over a fortnight before the Roys struck their deal after what they termed as “constructive” discussions with Gautam Adani.

Others reckoned that both parties wanted to avoid regulatory scrutiny.

The original deal between Adani and the Roys was legally above board but critics felt that it may have violated the spirit of the market regulator’s rules.

The market regulator does not explicitly provide for the payout of a control premium to promoters of a company when they cede control.

Under Sebi rules, the minority shareholders must get the same price in the open offer as that paid to the promoter.

Sub-section 7 of Section 8 of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 -– commonly known as the SAST Regulations -– says: “The price paid for shares of the target company shall include any price paid or agreed to be paid for the shares or voting rights in, or control over the target company, in any form whatsoever, whether stated in the agreement for acquisition of shares or in any incidental, contemporaneous or collateral agreement, whether termed as control premium or as non-compete fees or otherwise.”

The Adanis had mounted the takeover bid for NDTV in August and acquired RRPR Holding -– the designated promoter of NDTV which held a stake of 29.18 per cent -– by triggering certain provisions of a loan covenant.

The billionaire had first acquired Vishvapradhan Commercial Pvt Ltd (VCPL) and immediately pressed for the conversion of share warrants that RRPRH had issued to VCPL against a Rs 350 crore interest-free loan that the Roys had taken.

The warrant conversion gave the Adanis an indirect stake of 29.18 per cent in NDTV and, therefore, triggered the open offer. Since the RRPRH shares had not been actually purchased, the open offer was priced on the basis of a 60-day average preceding that transaction.

Another seller

There are a couple of other developments in the NDTV saga. After the open of fer closed on December 5, Investment Fund, a Mauritius-based foreign portfolio investor (FPI), sold 21.93 lakh shares through block deals in four different transactions. LTS, the biggest non-promoter shareholder in NDTV, held a stake of 9.75 per cent in NDTV.

It did not participate in the open offer. These shares were sold at prices ranging from Rs 339.03 per share to Rs 366.65. As of September 30 this year, LTS held 62.85 lakh shares in NDTV, which were acquired in August 2016.

LTS is also a shareholder in several Adani group companies: Adani Enterprises, Adani Transmission, and Adani Total Gas. According to the website of Financial Services Commission, Mauritius, LTS was registered in 2011 and its registered address is Cavell Street, Port Louis, Mauritius.

0 Response to " Rs 200 crore riddle in NDTV deal: : NDTV gave up a sum of Rs 207.23 crore that they could have potentially earned from the sale of 1.75 crore shares in the news broadcast company"

Post a Comment

Disclaimer Note:

The views expressed in the articles published here are solely those of the author and do not necessarily reflect the official policy, position, or perspective of Kalimpong News or KalimNews. Kalimpong News and KalimNews disclaim all liability for the published or posted articles, news, and information and assume no responsibility for the accuracy or validity of the content.

Kalimpong News is a non-profit online news platform managed by KalimNews and operated under the Kalimpong Press Club.

Comment Policy:

We encourage respectful and constructive discussions. Please ensure decency while commenting and register with your email ID to participate.

Note: only a member of this blog may post a comment.